‘Truth in every tone’: how layered voice analysis redefines lie detection technology

In the global arena of corporate security and fraud prevention, the stakes are continuously rising. As per Kroll’s 2023 Fraud and Financial Crime Report, a significant

“69% of executives globally predict an uptick in financial crime risks, with cybersecurity and data breaches being prime concerns.”

This widespread apprehension underscores the necessity for enhanced vigilance and the integration of advanced technologies in combating economic crimes. Reflecting on a wider scope, PwC’s Global Economic Crime and Fraud Survey from 2022 discloses that a substantial

“51% of organizations across various countries reported experiencing fraud in the last two years.”

This percentage is noted as the highest in two decades, pointing to a dire need for businesses to adapt and fortify their fraud prevention measures. According to a 2015 study by the Association of Certified Fraud Examiners (ACFE), an alarming 31% of companies in Mexico have experienced theft of goods or inventory, while 21% have been victims of fraud by sellers and suppliers. More shockingly, it’s estimated that 5% of company profits are illicitly siphoned off each year by the very individuals these businesses trust: their employees.

“Of the 1,388 fraud cases examined, a staggering 87% were perpetrated by first-time offenders from within the company.”

In 2022, the European Anti-Fraud Office (OLAF) safeguarded €600 million of EU funds, underscoring the importance of recovering over €426 million from fraud and irregularities. Concurrently, the European Public Prosecutor’s Office (EPPO) conducted over 1100 active investigations, with estimated damages amounting to €14.1 billion, focusing significantly on cross-border VAT fraud. These figures highlight the complex landscape of financial fraud within the EU, emphasizing the critical need for comprehensive fraud prevention strategies for private companies.

Undetected harmful behaviors by employees pose a significant risk for businesses globally. Studies highlight the need for better monitoring and screening systems

Considering these developments, the adoption of Layered Voice Analysis (LVA) and similar technologies could play a pivotal role in reinforcing corporate defenses against the multi-faceted threat of fraud. As companies navigate through an era marked by digital transformation and elevated fraud risks, LVA stands out as a sophisticated tool that aligns with the global trend of leveraging technology to safeguard organizational integrity. In the quest for truth, technology has always played a pivotal role. The polygraph, commonly known as the lie detector, has been a mainstay in investigative processes for decades. However, as we advance into a more technologically sophisticated era, a new player has emerged in the realm of deception detection: Layered Voice Analysis (LVA). Unlike the polygraph, which relies on physiological responses such as heart rate, blood pressure, and skin conductivity, LVA dives into the subtleties of the human voice. This approach is based on the premise that emotional, cognitive, and psychological states manifest in minute, often imperceptible changes in vocal qualities. LVA technology deciphers these changes, offering insights into the veracity of the speaker’s statements.

What is layered voice analysis?

Layered Voice Analysis (LVA) is a sophisticated technology that evaluates subtle frequency changes in the human voice to detect underlying emotions and stress, which can indicate deception. LVA focuses on vocal nuances that are affected by psychological states. It’s used in security, law enforcement, and corporate settings to enhance truth verification processes. LVA’s non-intrusive, real-time analysis offers a modern approach to understanding human emotions and intentions.

Layered voice analysis operates on the understanding that every spoken word carries a spectrum of frequencies, each influenced by the speaker’s psychological state. Stress, excitement, fear, and deceit all leave their unique fingerprints on one’s voice. LVA algorithms analyze these vocal nuances, identifying patterns that may suggest deceptive behavior.

Advantages over the polygraph

- Non-intrusive: LVA requires no physical contact, making it less intimidating and more comfortable for the subject.

- Versatile applications: It can be used in various settings, including over the phone, in media recordings, or in-person conversations, without the need for specialized environments.

- Real-time analysis: LVA offers the possibility of real-time deception detection, providing immediate insights during conversations or interrogations.

Applications of LVA

The applications of LVA are vast and varied. In the corporate world, it can enhance interviewing while hiring managers, security protocols, vet potential employees, and safeguard against internal fraud. Law enforcement agencies can leverage LVA for more nuanced interrogations and witness interviews. Even in the realms of psychology and healthcare, LVA can offer groundbreaking insights into emotional and mental states.

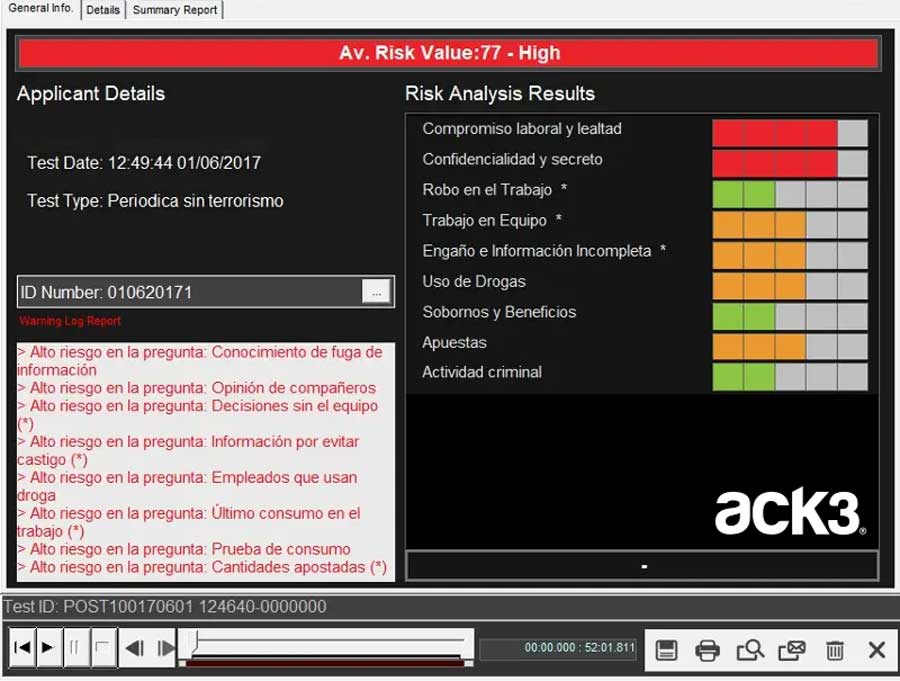

Examples of LVA automated reports.

Challenges and considerations

Despite its advantages, LVA is not without challenges. The accuracy of LVA can be influenced by various factors, including the subject’s emotional state, cultural background, and language proficiency. Moreover, ethical considerations regarding privacy and consent must be navigated carefully.

As businesses grapple with the challenges of internal fraud and deception, the integration of LVA technology could be the key to unlocking a more secure, trustworthy corporate environment. The ethos of “Truth in every tone” encapsulates the essence of LVA’s promise: a world where the subtleties of voice reveal the integrity of intent, empowering organizations to protect themselves from the inside out. Discover the transformative potential of Layered Voice Analysis (LVA) and redefine your approach to corporate security and trust.

Do you want to know more about the ACK3 Layered Voice Analysis?

For more information, click on the button.